SHANGHAI, Aug 17 (SMM) - On August 15, the Sichuan Provincial Department of Economy and Information Technology and the State Grid Sichuan Electric Power Company jointly issued the Emergency Notice on Expanding the Scope of Cutting Off Electricity Supply to Industrial Enterprises in Favour of Residents. The notice pointed out that due to recent large-scale and long period of extreme high temperature weather that has not been seen in years, the ongoing drought has led to a sharp decline in hydropower generation capacity, and the current power shortage situation has further intensified.

Starting from August 15th, the staggered power use shall be cancelled, and the implementation scope of cutting off electricity to industrial enterprises in favour of residents will be expanded in 19 cities (prefectures) in the province (except Panzhihua and Liangshan). All industrial power users who are included in the Sichuan Power Grid Orderly Power Use Programme (including whitelisted key security enterprises) shall stop production (except for security loads). This will take effect from 00:00 on August 15, 2022 to 24:60 00 on August 20, 2022.

However, in fact, most enterprises may be subject to a whole week of power rationing, or even longer.

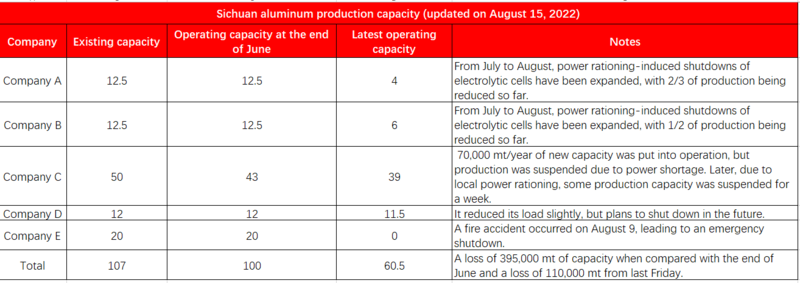

As big power users, aluminum smelters are facing great pressure amid the ongoing power shortages in Sichuan and persistent heat wave. Aluminum smelters in Sichuan have already started to reduce their production in accordance with the local power rationing policy, and the production reduction has rapidly expanded to 395,000 mt. The potlines of some smelters are still closed or operating at low capacity.

The current operations of aluminum smelters in Sichuan are as follows:

Impact of aluminium output cuts in Sichuan

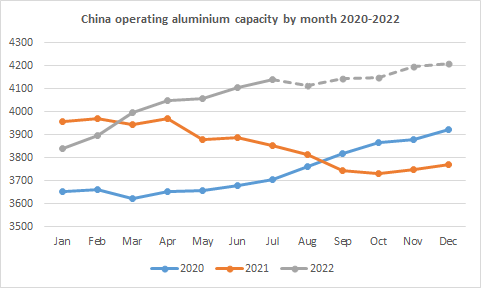

1. The operating aluminum capacity in China will increase more slowly than expected

The time for resumption of production may vary due to different approaches to production reduction. The latest round of output cuts in Sichuan came in many ways. The first was emergency shutdown caused by accident, which brought severe damage to the electrolytic cells. Smelters will need to repair their electrolytic cells before resuming production. If the electrolytic cells are seriously damaged, the repair will require a lot of time and money.

The second is the closure of electrolytic cells in the conventional way. At present, most aluminum smelters in Meishan adopt this approach, under which molten aluminum in electrolytic cells are drained, followed by orderly shutdown of electrolytic cells. In order to resume the production, smelters will only need to heat their electrolytic cells, and it will take some time from the restarts of cells to the normal production.

The third is production restriction in a strict sense, and it is also a common output control method in the aluminum industry, namely, reducing the load rather than shutting down completely. The furnace temperature is maintained and no aluminum is produced during the period of load reduction, and aluminum is produced in a centralised manner once the power load is sufficient. This method of production reduction generally applies to intraday off-peak production.

Aluminum smelters minimise the impact by adjusting the time for aluminum production and staggering the peak period of electricity use, but this approach cannot be used for long period of low-load operations and poses certain safety hazards. At present, some aluminum smelters in Guangyuan are adopting this method. However, there is no way to tell when the power supply will return to normal. Smelters will have to shut down their electrolytic cells if low-load operations take longer than expected.

Aluminum capacity likely to decline in the future

No matter what approaches smelters in Sichuan adopt to reduce their production, SMM estimates that it will take at least 2 months for the operating capacity to reach the level seen at the end of June. Given the ongoing shutdowns and uncertainty as to when the production will resume, the recovery of aluminium output in Sichuan may take longer than expected. Therefore, SMM has once again adjusted its forecast for the future operating aluminum capacity. SMM now expects that the domestic operating aluminum capacity will drop 270,000 mt MoM to 41.13 million mt at the end of August, and the domestic aluminum output will fall to around 3.47 million mt this month. Considering the future resumption of production in Gansu and Guangxi, as well as the release of new capacity in Gansu and Inner Mongolia, the domestic operating aluminum capacity may reach 42 million mt by the end of this year.

Lagging impact on aluminum prices

SMM understands that the main reasons for the recent weakness in aluminum prices are as follows:

First of all, the latest data showed that China's industrial added value and total retail sales of consumer goods fell year-on-year in July, and the national real estate development investment fell by 6.4% from January to July this year, triggering bearish macro sentiment.

Secondly, the domestic downstream aluminum consumption is still in the off-season. End demand, led by real estate, continues to be sluggish. The domestic aluminium ingot social inventory continues to grow.

Thirdly, aluminum smelters in Sichuan mainly supply molten aluminium to downstream enterprises the local and surrounding regions. The output cuts by smelters in Sichuan are accompanied by production reduction by downstream enterprises, thus the short-term supply-demand balance was little disrupted.

Once the power issue is eased in the future, downstream enterprises are able to resume production rapidly while smelters will not keep up. As such, Sichuan may see a supply gap in the future.